Africa’s stock exchanges will play a vital role in the continent’s post-COVID recovery – they not only stimulate financial activity and mobilise funds to productive ends, but also boost the liquidity and depth of their capital markets. While the JSE, as the continent’s largest bourse, is very much a proxy for macro-economic trends, it continues to work towards sustainably growing, diversifying and developing its markets. And here, collaboration with other African exchanges is crucial, says Anne Clayton, JSE Head of Public Policy.

She underlines the importance of regional integration and partnerships instead of rivalry to promote intra-African opportunities for both investors and issuers. To this end, the JSE is a leading voice in regional as well as continent-wide partnerships, such as the Committee of SADC Stock Exchanges (CoSSE) and the African Securities Exchanges Association (ASEA). ‘As a CoSSE-member exchange, the JSE is, for example, involved in the SADC Green Finance programme, run by specialist development agency FSD Africa to develop a green-bond market in the region,’ according to Clayton. The partnership addresses the climate agenda by aiming to accelerate the uptake of green bonds by SADC member countries to finance sustainable green projects.

The CoSSE member exchanges are currently drafting guidelines and principles to harmonise the listing of green bonds on their own platforms. FSD Africa has already developed a similar tool that issuers in the region can refer to for general guidance.

The JSE, as part of CoSSE, is also participating in the SADC-EU programme on Support to Improving the Investment and Business Environment (SIBE) in the SADC region. ‘The objective is to achieve sustainable and inclusive growth, and to support job creation, through transforming the region into a SADC investment zone, and promoting intra-regional investment and foreign direct investment in the region,’ says Clayton. She explains that the SIBE programme aims to enhance the regional integration of financial markets, and improve financial inclusion and access to capital, in particular for SMEs with a turnover of up to $6.2 million.

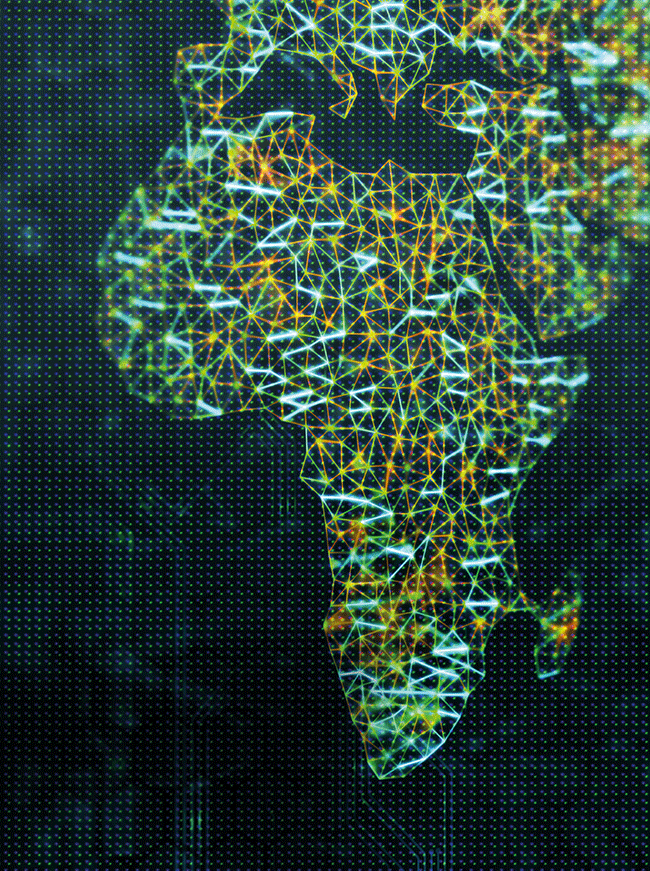

‘At the JSE, we are aligned to the African Union 2063 Agenda, which intends to build a strategic framework for inclusive growth and sustainable development right across Africa,’ she says. ‘We are also in support of the African Continental Free Trade Area Agreement, which is set to provide opportunities for African investors to increasingly invest across African markets. African exchanges have been considering ways to address the liquidity challenge facing many of our markets, so we’re now focusing specifically on pan-African flows in addition to seeking foreign investments.’

A cross-border collaboration called the African Exchanges Linkage Project (AELP) could be a game-changer in this arena. ASEA’s flagship project is expected to drive pan-African trade through a shared order-routing system that will enable Africa’s exchanges to facilitate trade on each other’s markets. Supported by the AfDB, the first project phase is due to kick off before the end of March 2022. In addition to the JSE, there are six leading exchanges participating in AELP, which together account for more than 1 050 African companies. In total, these are valued at $1.2 trillion, or 95% of the market cap of the continent’s exchanges.

Clayton points out that in the future AELP will help African companies to raise capital through issuances across multiple jurisdictions, which will in turn increase the participation of domestic and foreign institutional investors in Africa.

‘As a participating exchange, the JSE benefits by being a part of this collective that enables sustainable and inclusive growth and development, not only in South Africa but on the continent as a whole,’ she says. ‘Therefore regional collaborations such as the AELP will continue to be at the centre of securing a post-pandemic growth path for Africa.’