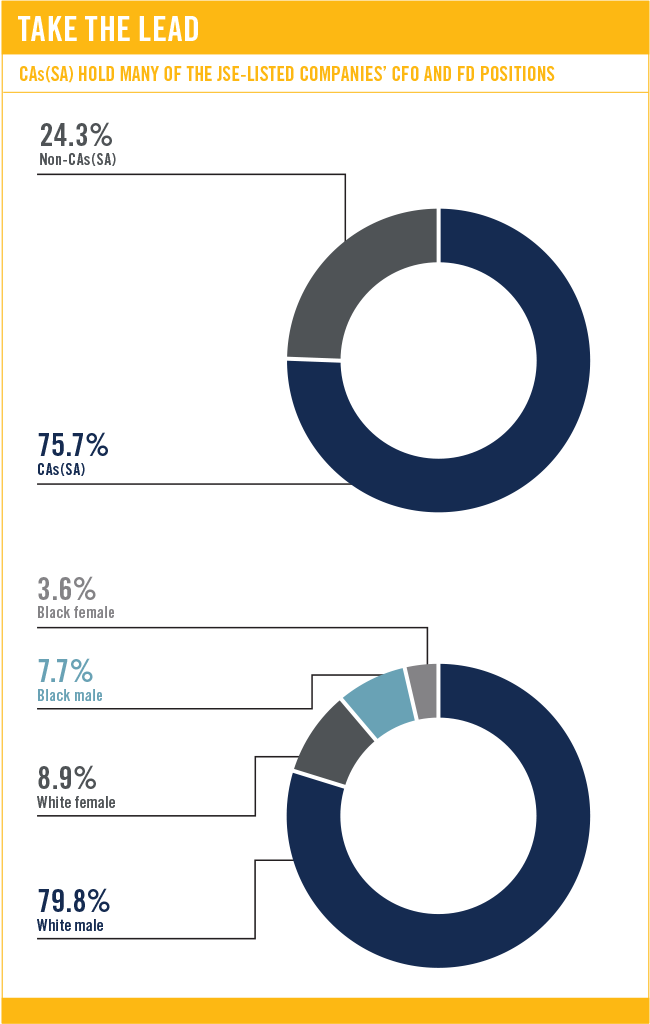

A 2016 survey by the South African Institute of Chartered Accountants (SAICA) of companies listed on the JSE (including AltX) confirms that more than 75% of chief financial officers (CFOs) or financial directors (FDs) hold a chartered accountant – CA(SA) – designation. By far, this makes a CA(SA) the leading qualification among financial executives.

On average, SA’s listed businesses have 2.5 CAs(SA) on each board of directors – executives who ensure the reliable levels of financial reporting and governance on which investors and trustees of pension funds depend for their decisions.

According to Lindie Engelbrecht, executive director of SAICA, financial accountability lies mainly with the CAs(SA) in leadership roles, as well as with the directors heading audit sub-committees. It’s important that the CFO or FD has a strong affinity for interpreting numbers, strategic expertise and the aptitude to communicate strategy, she says.

To what extent have SA companies succeeded in transforming the overall profile of those holding the key CFO and FD positions?

‘Significantly, there are hopeful signs of transformation among the younger generation. Through the Thuthuka Bursary Fund (TBF), we now have hundreds of potential black CAs(SA) in the educational pipeline,’ she says.

SAICA established the TBF to create more opportunities for talented African and coloured SA students who excel in mathematics to study towards becoming CAs(SA). Engelbrecht says that SAICA’s transformation efforts are already helping to turn the tide.

‘More than 50% of SAICA’s annual output of CAs(SA) are now black, and in terms of the gender split, 50% are female. In the top 40 companies, SAICA’s efforts are even more pronounced, with just over 59% of CAs(SA) under 50 years old being black. Given the right opportunities, the newly qualified professionals will become our senior directors of the future.’

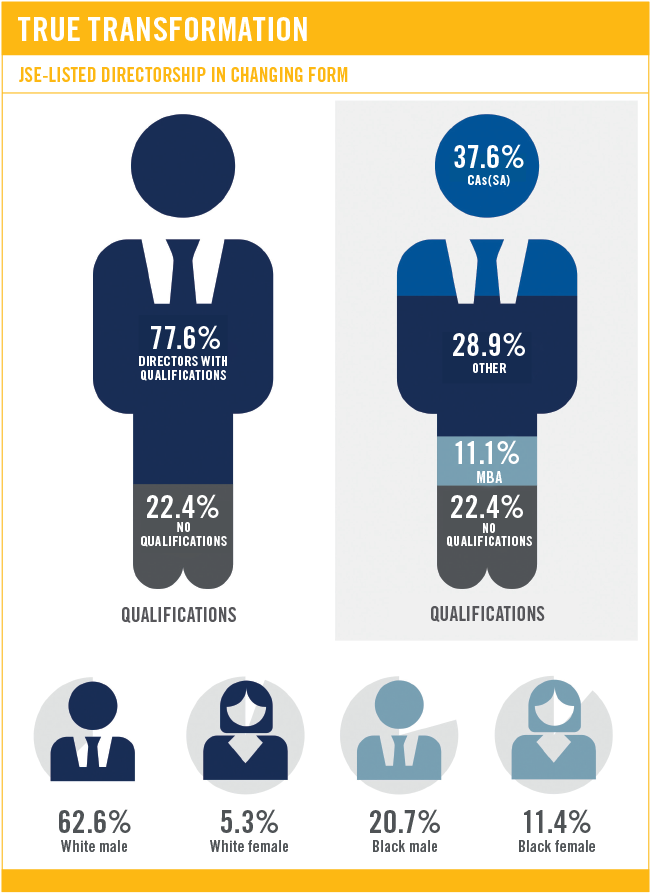

However, recent research on JSE-listed companies has identified a growing trend in terms of the appointment of directors who don’t have formal qualifications.

An obvious concern is an increase in the percentage of directors who fall under this category – from 18.2% (a little more than a year ago) to 22.4%.

‘Boards are under increasing pressure to reflect diversity in their make-up, while BBBEE mechanisms increase the pressure to appoint more people of colour, as well as more black females in particular, to big company boards.

‘Some new board members would have been appointed on the strength of their leadership ability, experience and their ability to raise diverse opinions,’ says Engelbrecht.

In a 2007 study titled Board Barometer, a way of measuring the effectiveness of listed companies’ boards postulated and then proved that the more diverse the make-up of a board, the more likely the board was to approve strategies that created wealth. Additionally, a diversified board was more likely to hold executive management to account. The study also suggested that this diversity could not compromise the basic ambit of skills that a board would need to come to good value-creating conclusions.

The results were conclusive – the Top 40 index reweighted away from market capitalisation and using the quality of make-up of the board as the weighting criteria, significantly outperformed the index.

In other words, a move to include board members who are more diverse in age, gender, race and technical experience would be a good thing, the study concluded.

Today, according to Engelbrecht, SAICA has reason to celebrate rather than to be despondent about the findings of its 2016 study of 413 companies, across all sectors, listed on the JSE’s Main and AltX boards.

‘While the overall percentage of directorships who hold no qualifications has increased in the past year, the percentage of those who hold a CA(SA) qualification as a percentage of all academically qualified directors has increased from 37% in 2015 to 37.6% in 2016.

‘CAs(SA) are also 2.5 times more likely to be appointed to South African listed company boards than any other designation or qualification. With the average number of directors per board declining slightly to 8.8, it is heartening to know that on average there are 2.5 CAs(SA) on each board watching over the financial health and governance standards of the underlying companies.’

So while there may be an increase in the total number of directors who don’t have qualifications, they are suitably qualified through the ‘school of hard knocks’, according to Engelbrecht.

‘That, together with the 77.6% of directors who have academic qualifications, suggests that our boards – given the Board Barometer research – are in safer and possibly better hands than they have ever been.’