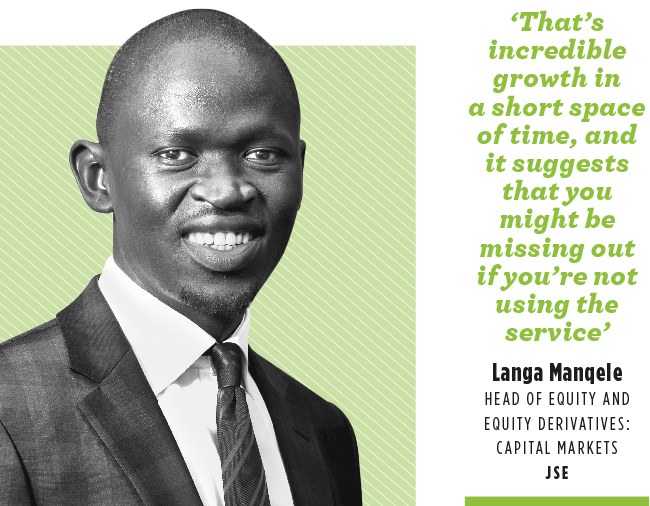

It takes about 15 hours, give or take, to drive from Johannesburg to Cape Town. For traders using the JSE’s colocation facility, data travels that distance in just 20 microseconds. In the world of high-speed trading, where every minute matters, that low latency represents a significant advantage. A microsecond, after all, is one-millionth of a second. It’s fast, says Langa Manqele, Head of Equity and Equity Derivatives at JSE Capital Markets, because it has to be.

‘Because of the high demand in terms of split-second latency, traders cannot afford to use a generic data centre,’ he explains. ‘You have to be where the trading engine is. You can’t use a generic data centre in, say, Cape Town or Durban or wherever.’

To illustrate the point, Manqele doesn’t even have to leave the JSE’s postal code. Latency between the exchange’s on-site colocation facility and the surrounding Sandton area is just 2.7 microseconds, compared to the 2 400 you’d reasonably expect from a generic data centre.

The technology is light years away from when the JSE introduced electronic trading in 1996. When the exchange launched its own colocation centre in 2014, designed to Tier 3 standards, it was with the intention of allowing clients full access to their own server space in its data centre. ‘Because of the need for us to ensure availability of the service, it is best that we as the JSE have oversight of our own data centre,’ adds Manqele. ‘We can’t afford to have our data centre run by a third party. We have our own team, our own power supply, cooling system, backups… For clients, that all adds to the benefits of having your equipment in an exchange-owned data centre.’

Those benefits are reflected in the high demand for rack space. ‘When we launched the colo centre in 2014, it handled about 20% of the JSE’s trading activity,’ says Manqele. ‘By mid-2022 we were at about 65%. That’s incredible growth in a short space of time, and it suggests that you might be missing out if you’re not using the service.’

Most of the JSE’s colocation clients are Top 10 firms, based in and around the Sandton CBD. ‘Many of them also service offshore clients in places like London, Amsterdam, Frankfurt, New York and so on, who are trading on JSE-listed companies,’ he says. ‘Some clients have colo racks in their own name; while some use managed service providers, who rent out space in our facility.’

Due to the high demand, the JSE’s colo team has expanded the facility to accommodate 71 racks. ‘We’re running out of physical space to add new racks, so we’re knocking down the adjacent space and building it out to add about 43 additional racks,’ says Manqele. That added capacity should be available by early 2023.

‘The colocation space is being impacted by the global chipset shortage, which has created longer lead times,’ he says. ‘So you have to plan in advance. We’re seeing clients trying to frontload their colo rack orders so that they have time to bring in equipment.’

Yet forward planning and risk mitigation are all part of the job for Manqele and the team.

‘We promise minimal downtime, and we deliver that,’ he says. ‘The JSE had about 30 minutes of downtime in July, when we proactively took the decision to shut down the market so that everyone could have fair access. But that was a generic network issue. It had nothing to do with colocation. We’ve never experienced downtime at our colo facility because of load shedding or anything like that.’

He’s right – when Manqele spoke to us, it was during Stage 3 load shedding. The lights were out in most of the surrounding buildings, but the colo servers were still humming along.