The JSE has made pioneering forays into the market through listing a range of commodity derivatives, the latest being a cash-settled merino wool futures contract.

The contract allows farmers and wool buyers to protect themselves against movements in the wool price and comes shortly after the listing on the JSE of lamb and beef carcass futures contracts.

Adding wool to the range of livestock products has been a great leap for the JSE.

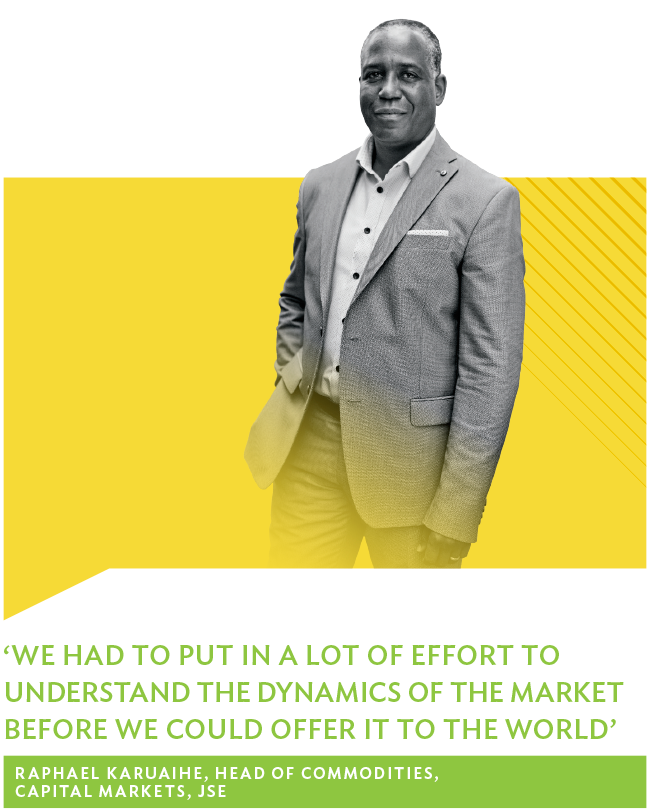

‘It was a significant milestone. We had to put in a lot of effort to understand the dynamics of the market ourselves before we could offer it to the world,’ says Raphael Karuaihe, Head: Commodities, Capital Markets for the JSE.

Merino wool is considered to have tremendous potential as the demand for wool is particularly good, with global wool production currently at a historic low. The settlement price of the new contract is determined by the Merino Indicator, an index created by Cape Wool SA.

‘We have partnered with Cape Wool SA, the custodians of the wool index. We use the index to settle expiring instruments. The nominal size of the contract is 1 000 kg and we use a basket of different wool varieties on a weighted basis to determine the underlying tradeable commodity,’ says Karuaihe.

The index reflects movements in the price of wool by calculating the weighted average price of a basket of wool sold at a specific wool auction compared with the result of the previous auction. Auctions are held in Port Elizabeth every week during the wool-growing season.

Karuaihe argues that diversifying into different agricultural products is key to growing the commodity derivatives market. The beef carcass contract was launched in 2016, followed by the lamb carcass contract. Both were developed in consultation with their respective industries.

‘We respond to market demand for new products, and so a combination of market research and demand from market participants remains our driving force for launching new products.’

Grains, mostly white and yellow maize, sunflower and soya bean products, have made up the largest part of the commodity derivatives market.

‘South Africa produces around 15 million metric tons of combined grains in a typical year. The JSE commodity derivatives market can be limited by the size of the underlying market since we can only turn the underlying market so many times over. This requires us to always be on the lookout for new opportunities to grow our business,’ says Karuaihe.

The core business of the JSE derivatives market is to provide price-risk management tools to the market, enabling traders to protect themselves against a rise or fall in the price of commodities.

Karuaihe sees the commodity derivatives market as a ‘well-established household name’ within the agricultural community. It also holds the promise of more opportunities.

‘One area where we could expand and have influence in the agricultural sector is to join forces with established agribusinesses to offer solutions to emerging farmers of our country,’ he says.

‘Many agribusinesses in the past have tried to score points in assisting the emerging farmer. The good news is that most companies are now realising that it is better if we can share the risk and make this a joint effort.’

Karuaihe adds that the JSE was involved in talks with other market players to identify which offerings to emerging farmers would most benefit everyone concerned.

He says that SA is unique in the way the commodity derivatives market has evolved.

‘We moved from a regulated environment for grains straight into a derivatives market environment when the agricultural sector was deregulated in 1995. This means that there was no time to develop a spot market for grains and, as a result, our commodity futures prices for deliverable products have become benchmark prices for the cash market.

‘Simply put, we can’t imagine a functioning spot market for grains in South Africa without the JSE commodity future prices.’