Canada is a wealthy developed country (GDP per capita is $53 000), offering a technologically sophisticated market of 40 million people and an extremely open economy. It has the world’s 10th-largest economy and the Heritage Foundation ranks it as the most free economy in the Americas.

‘What many do not realise is that Canada is an attractive investment destination in its own right,’ says Chris Cooter, Canadian high commissioner to SA. ‘Canadians regard South Africa as an entry point to the sub-Saharan market. Helping develop the African Continental Free Trade Agreement is actually one of Canadian Trade Minister Mary Ng’s objectives in her mandate letter.’

He adds that Canadians find SA a relatively easy work environment ‘with similar legal, regulatory and banking systems and similar goals, such as gender equality, diversity and inclusion’. Both countries are, of course, former British dominions and members of the Commonwealth.

Cooter says Canada already has significant relationships with many African countries and a significant language advantage in francophone Africa, with French being one of Canada’s two official languages. He notes that Canadian firms find SA’s knowledge of and links with the rest of the continent extremely useful, and that there is considerable scope for co-operation and joint ventures.

Mike Morgan, CEO of the Johannesburg-based Southern Africa-Canada Chamber of Commerce (SACANCHAM), argues that ‘first prize is getting Canada’s C$4.5 trillion institutional investor industry interested in South Africa’. He says he has information suggesting that SA institutions invest three times more in Canada than the reverse. ‘We [SACANCHAM] are working hard, together with the [Toronto-based] Canada-Africa Chamber of Business and the two high commissions to raise the profile of South Africa in the eyes of Canadian institutions.’

Morgan says there is a concerted effort under way on this front. ‘Both high commissioners – South Africa’s Mo Shaikh in Ottawa and Canada’s Chris Cooter in Pretoria – have been very active.’ He argues that ‘bilateral relations are very strong, with meetings every year, spanning not only government but also being very strong in education and research’. Cooter adds that the SA-Canada Higher Education and Science Councils Network, established in May 2023, reinforces established ties. ‘The new emphasis will increasingly lead to stronger commercial relationships, especially in emerging sectors,’ he says.

It is not surprising that assessments of the relationship between Canada and SA tend to focus on the mining space. After all, these are two of the great mining jurisdictions, and the engagement between the two has been deep and extensive for many years.

Currently, Toronto-based supermajor Ivanhoe Mines is developing a large platinum resource at Mokopane in Limpopo. The multi-shaft underground mine is scheduled to start production in 2024. Ivanhoe is, of course, best known for its gigantic tier one Kamoa-Kakula copper mine in the DRC, currently in production and still under development. At full development it may well be the world’s biggest copper mine. Mokopane will see Ivanhoe’s local subsidiary, Ivanplats, join SA’s ‘big four’ platinum producers.

Nor is the interest only in one direction. Gold Fields announced earlier this year that it was establishing a joint venture with Canadian First Nation-associated Osisko Mining to develop the Windfall gold project in Québec. Gold Fields, which is listed on the JSE, will initially invest C$300 million to acquire half the project. Johannesburg-headquartered diamond miner De Beers has also invested billions of dollars in Canada and provides a link between the two economies.

The Toronto Stock Exchange (TSX) is the go-to space for junior mining fundraising, thanks to Canada’s innovative ‘flow through’ share scheme, which allows investors in mining exploration and development to claim back their entire investment as a tax loss should the company fail.

‘Mining exploration is a high-risk game,’ according to Paul Miller, CEO of SA mining-investment company AmaranthCX. ‘You can expect something like 99% of all ventures to fail. It’s a difficult space to incentivise, but the Canadians have pulled it off.’

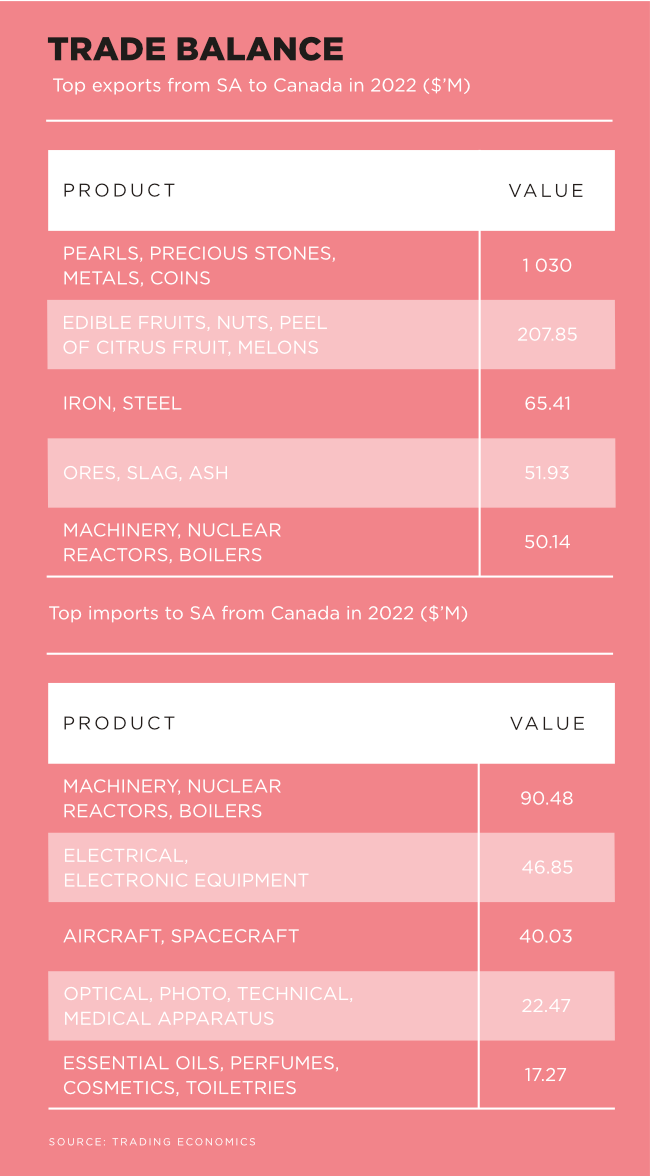

Forty percent of the world’s mining companies are listed on the TSX, and the industry active in Canada alone is worth more than C$100 billion. SA’s largest export to Canada is platinum (used by Canada’s automotive manufacturers), valued at $713 million in 2021 and accounting for more than half the country’s trade with the North American nation. The total value of platinum exported is nearly 10 times that of SA’s second-most valuable offering, citrus fruit.

Miller, however, is of the opinion that despite a deep history of mining links between SA and Canada, relations are experiencing a hiatus at the moment. ‘South Africa’s dysfunctional institutional arrangements in mining, combined with issues like energy security, mean that Canadian junior miners have adopted a “wait and see” attitude,’ he says, adding that of the 1 200 junior mining companies listed on the TSX, ‘only a handful are exploring in South Africa, even though everyone knows there’s a great deal of wealth waiting underground’.

According to government agency Natural Resources Canada, just 17 of these firms are active in SA, with an additional 16 working in Namibia. Interest is apparent – there were 64 Canadian companies at 2023’s Mining Indaba in Cape Town, according to Cooter. The problem, argues Miller, is that large-scale investment is not following.

However, there’s a lot more to the relationship between the two countries than mining. ‘The relationship between Canada and South Africa transcends the mining space,’ says Morgan. He points out that, in SA, Canadian companies are active in ICT, financial services, food and agriculture and energy, among other things.

McCain Foods, the world’s largest manufacturer of frozen potato products, is a Canadian company with substantial SA investments. The company, which says it accounts for one in four fries sold globally, has production facilities in Delmas and Marblehall, as well as a national distribution network.

Another Canadian investor, Toronto-listed AGT Foods, is a major player in the SA seeds, grains, flour, pulses and spices markets.

Morgan points out that Canada has burgeoning education, energy, ICT, agricultural and cultural industries. Speaking in November 2023, he said he had recently attended the big AfricaCom telecoms, media and technology conference in Cape Town, and that he had met 39 Canadian firms active in the digital space and looking to ‘create a presence in Cape Town or Johannesburg, and develop strategies for Africa beyond those cities’.

One prominent Canadian IT company, OpenText, a leading information management solutions service provider, has an SA operation, with a Level-1 BEE rating, a digital academy and a distribution network into the rest of the continent, he says.

The ICT sector in Canada employs 800 000 people and has annual sales of C$273 billion. Big Canadian tech companies such as Shopify, GCI, Constellation Software and OpenText, are among the word’s leading firms in IoT, AI, cybersecurity and fintech.

Cooter points out that ‘the Toronto-Waterloo corridor has the world’s highest concentration of corporate innovation labs. Google, Meta, Amazon Web Services, Samsung and LG all have research facilities in Canada’.

There’s a lot of potential synergy between Canada – with its advanced technology – and SA, where there is development not only in ICT but also renewable energy, critical minerals and green hydrogen. Canada has made C$400 million available for SA’s just energy transition and has also recently joined the Square Kilometre Array Organisation, the huge high-tech astronomy development based around Sutherland in the Northern Cape.

‘This year is the 30th anniversary of the end of apartheid,’ says Cooter. ‘I hope the occasion will renew and add new momentum to our relations.’