Former ambassador Tony Leon, who was Pretoria’s man in Buenos Aires from 2009 to 2012, points out that Argentina and SA have economies of about the same size and populations in the same range. They also produce similar things. Both have large, export-oriented agricultural sectors – including maize, livestock and highly regarded local wine industries – as well as established manufacturing sectors, including automobiles, and considerable mineral resources.

Both countries experienced and overcame authoritarian rule in the late 20th century. Argentina threw off the yoke of military dictatorship in December 1983, while SA’s transition from apartheid rule followed a decade later. Full diplomatic relations, suspended after the return of civilian government in Argentina, were resumed in 1991.

Economic parallels and geopolitical positions suggest that there should be a thriving partnership between the two countries. But the relationships that exist tend to be sporadic, partial and often short-lived. Even joint naval exercises, in the form of Exercise Atlasur, which also involves Brazil and Uruguay, have been in suspension since 2018. Before that, the exercise had been held 10 times and had been considered an important test of joint doctrine in securing the South Atlantic commons.

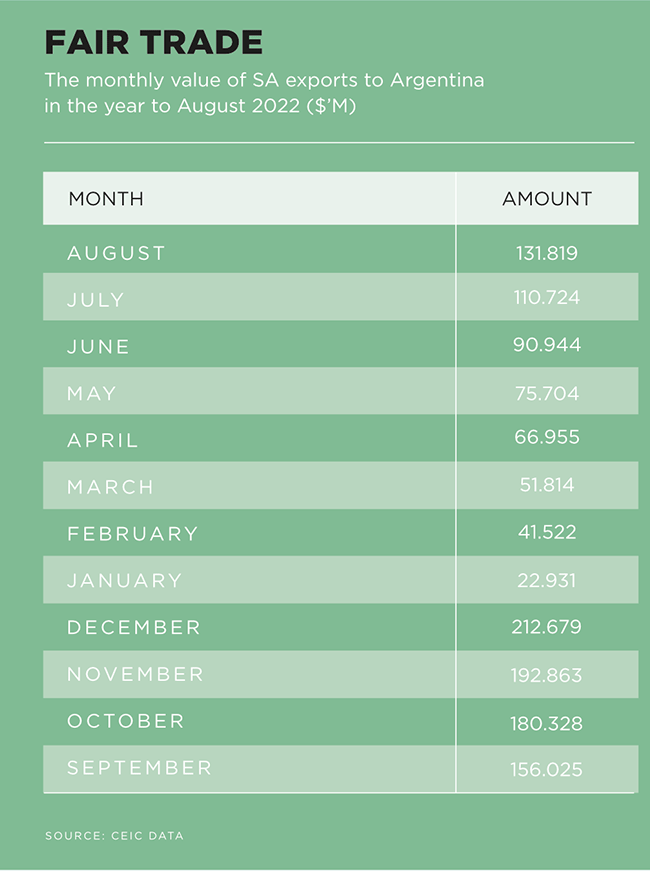

The current SA ambassador to Buenos Aires, Phumelele Gwala, says that ‘bilateral trade figures are rather modest and do not reflect the true potential’. The trade and investment relationships between the two countries have been characterised by promising starts that do not last beyond a few years, as well as some large and obvious gaps.

From the SA side, Standard Bank was an early mover when in 2007 it bought Bank Boston Argentina, then the country’s fifth-largest bank. As Leon comments, ‘that created a following wind for all sorts of other activities. These included phosphate fertiliser exports from South Africa and the establishment of a facility by South African packaging company Nampak. At the embassy we had many visitors from South Africa, seeking business opportunities’. But Standard sold most of its stake to the Industrial and Commercial Bank of China in 2011 and its remaining shares in 2019.

According to Leon, ‘there is an established trade pattern where Argentina exports much more to South Africa than it imports’. He says that when he started his term as ambassador, the ratio was ‘something like 10-to-one’. This has now narrowed somewhat but was still more than five-to-one in 2019. That year, Argentina’s exports to SA were valued at $600 million while products flowing across the South Atlantic in the opposite direction were valued at just $137.6 million.

These are almost trivial volumes. SA is the 47th-largest export market for Argentina, exponentially smaller than its biggest trade partner, Brazil, which accounted for 35.2% of all its exports in 2020. Argentina was SA’s 42nd-most important export market in the same year.

‘Argentina has the pampas, one of the most fertile agricultural regions on the planet. It produces food – mostly soy beans and corn – which could feed half-a-billion people,’ says Leon. In fact, Argentina’s biggest export to SA is soya beans and soya meal, valued at $121 million in 2021.

In Gwala’s view, ‘trade between South Africa and Argentina has not reached the optimum level. Both governments need to do more to remove remaining obstacles to trade. We simply have to make it easier for our business representatives to explore new markets in both countries and in our respective regions’.

A similar start-stop pattern is demonstrated by one of Argentina’s biggest investments in SA. San Miguel, based in the city of the same name (30 km north of Buenos Aires), is one of the world’s largest citrus fruit businesses. It invested $13.8 million in cultivation, packaging and export infrastructure in the Eastern Cape’s Sundays Valley in 2010. The company jumped through all the required BEE hoops and established the Thudana Citrus Trust, 30% owned by local workers. In 2019, the company’s assets were valued at $14 million.

A few months ago, San Miguel announced it was to sell its SA business to Spain’s Citri&Co. As part of the deal, the company’s Peruvian operations were sold to the same buyer. It said at the time that these moves were part of a shift to lemon production and a focus on lemon derivatives. There is no reason to doubt its sincerity and the EU’s protectionist shift regarding SA citrus exports was not mentioned. Whatever the details, the sale fits with a pattern between Argentinian and SA businesses, in which good business appears to be done for a few years before they disengage.

Perhaps the most significant gap between Argentina and SA involves the extinction of regular air links. Eugenia Vijande, head of the commercial section at Argentina’s embassy in Pretoria, comments that ‘this is currently the biggest problem’. She notes that prior to about 2014 there were virtually daily flights between the two countries. ‘South African Airways [SAA] had flights between Johannesburg and Buenos Aires several times a week and there was an Air Malaysia flight from Cape Town. These ended some years ago.’

SAA dropped its Buenos Aires flights in 2014, citing its business turnaround plan (the airline’s ninth) and the need to cut costs. Travellers from SA to Argentina now have to fly via a stopover in Luanda (Angola) and São Paulo in Brazil, if they do not use even more complicated routes involving Europe or the Middle East. ‘To get from South Africa to Argentina took a 28-hour flight the last time I travelled that route,’ says Vijande.

When direct flights were available, the travelling time was about eight hours. Severing the direct air link has had a large and negative impact on business generally, but tourism in particular. ‘Destinations like Kruger National Park and Cape Town are well known in Argentina,’ says Vijande. ‘The problem is that these used to be a one-week getaway but with flying now requiring two days in each direction, that’s now impossible.’

According to Leon, the 2010 FIFA World Cup created ‘a huge following wind for South African tourism. About 20 000 Argentinians visited South Africa for the event and saw their team reach the quarter finals’. Neighbouring Uruguay, whose fans would have used the same flights, reached the semi-finals. But with the disappearance of direct air links, numbers have dropped. For the whole of 2019, arrivals in SA were 15 533. Then came the collapse induced by COVID-19 restrictions on travel. For the first quarter of 2022, there were a mere 401 arrivals from Argentina in SA.

Gwala points to another aspect of the unfulfilled potential between the two countries. Both have thriving wine industries of some repute, yet products are not mutually available on supermarket shelves. ‘It is hard to find South African wines in Argentina. There are very few available, thanks to tariffs,’ she says.

‘Argentina is one of the world’s most tariff-protected economies,’ says Leon. ‘There are elements in the Argentinian government who are extremely hostile to business, much more so than in South Africa.’ Last year the World Trade Organisation described Argentina as being one of the 15 most protectionist economies in the world. SA, Leon adds, ‘is more open, despite a recently found appetite for tariffs’.

He suggests that policy in Argentina is very volatile and swings depending on whether a left wing (Peronist) government or a more market-friendly (centre-right) government has been elected. The present government is said to be divided between the centre-left president, Alberto Fernández, and his vice-president, the ultra-left Cristina Fernández de Kirchner.

‘Class is the big dividing line in Argentine politics,’ says Leon. ‘These swings are an impediment to political stability.’ This is the reason for the current pressure on the Argentine peso and an inflation rate expected to hit 90% this year. SA enjoys much greater stability but also suffers from stagnation, he adds.

Both countries face severe economic headwinds at present. Despite this, their relationship should be deeper. Vijande says the joint bilateral commission (established in 2005), which links the two countries at a ministerial level, has not met since before the pandemic. She says plans are afoot to have it meet again in the near future. If it were to make progress in establishing an air link and aligning trade policies it could bring the two South Atlantic powers closer together.