As the price of gold hit all-time highs in early December of near $2 150 an ounce, investors continued to pile into gold miners listed on the JSE. Alex Kuptsikevich, FxPro senior market analyst, described these gains as ‘legendary moves’. And owing to the weaker rand, in domestic currency terms, the gold price is well into record territory at more than R1.2 million per kilogram.

Which are among the best-performing companies on the local bourse this year? Gold miners including Harmony Gold (up 90%) and Gold Fields (up more than 50%). Even smaller producers such as Pan African Resources and DRDGOLD are up double digits.

While any positive momentum in the price of the precious metal (whether in dollar or rand terms) is positive for gold miners listed on the JSE (and on other markets), investing in miners of the metal will effectively achieve leveraged exposure to the gold price. Basically, the theory is that costs will not rise even as the price of their key product – bullion – does.

A weaker rand offers an additional boost, although certain operating costs are dollar-based and increase in lockstep. So, at a gold price of more than R1 million per kilogram, many miners are able to operate at all-in costs of R900 000 (or under). Thus, every incremental increase in the price of gold (and decline in the rand-dollar exchange rate) drops straight to the bottom-line as profit (miners often hedge, or lock in, portions of their output to protect themselves from a decline in the metal’s price).

Beyond the attraction of this operating leverage, investors also tend to buy gold as it typically has limited correlation with other asset classes. In effect, it acts as a hedge against other financial assets. So, as global equities slump, for example, gold tends to outperform (a so-called negative correlation).

The reasons for investors holding gold – via directly through, for example, an ETF, or via miners of the metal – have changed markedly in recent years. Herman van Papendorp, head of investment research and asset allocation at Momentum Investments, explains that US interest rates are no longer the ‘dominant driver of the US dollar gold price’ as they have been for the past few decades.

‘This relationship has broken down since the Russia/Ukraine war,’ he says, estimating that non-US interest rate ‘factors are adding more than $1 200 an ounce to the current gold price’. Van Papendorp says that in 2022 the buying of gold by central banks was at the highest-ever level. Much of this purchasing is not being disclosed publicly.

In a note to clients back in 2021, Nicholas Hops, head of South African equity research at fund manager Coronation, argued that ‘gold is an inexpensive insurance against risk, and we believe that the gold equities currently provide historically cheap exposure to gold’.

Hops said then that the only way to access gold was through equities – in other words, miners – until the advent of gold ETFs in the early 2000s. This meant that, historically, investors paid a premium for risk protection when buying shares in gold miners. Since the ETF boom, miners de-rated. In the local market, this was compounded by poor capital allocation by SA gold companies.

‘At the top of the last gold bull cycle in 2012, the gold sector, on average, continued to invest heavily in growth projects, and mergers and acquisitions. When the gold price began to decline, these capital commitments were met with debt as operating cash flows subsided,’ said Hops.

‘This left the entire industry needing to reduce costs, which had run up aggressively with the gold price, and reduce debt over a multi-year period. The gold sector’s poor cost control, poor capital allocation and high valuations all contributed to Coronation not having had a meaningful position in gold equities for nearly two decades. We believe a lot has changed.’

Hops said that capital allocation and cost control has improved, with the resultant better cash flow able to be paid out to investors as dividends (or via share buybacks).

Until recently, JSE-listed gold shares had performed worse than their global peers over most measurement periods. Hops said this meant that ‘investors were able to buy the stocks at large discounts due to general disenchantment with the mining sector, and the gold miners in particular’.

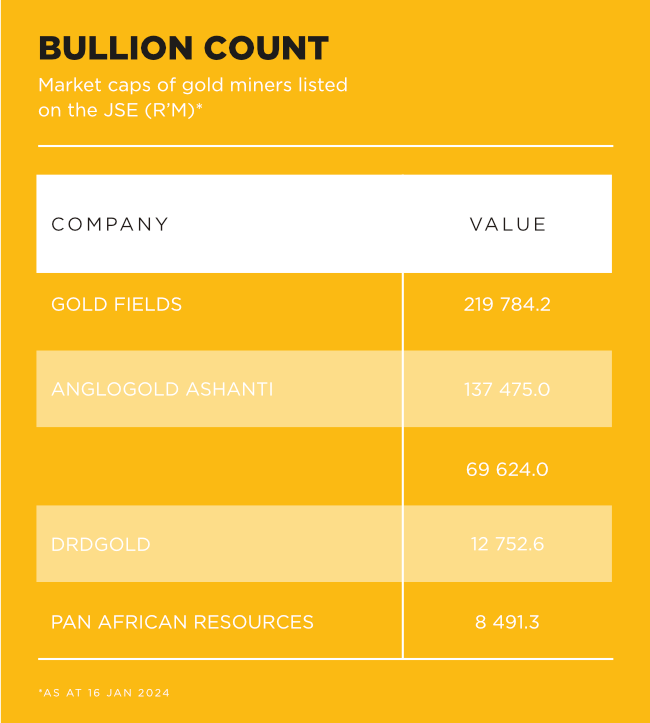

This thesis has played out almost exactly. There are several listed in this sector, along with another, Sibanye-Stillwater which holds a portfolio of domestic gold assets but is listed in the platinum sector. Together, the gold sector has a market value of nearly R500 billion, which is just more than a third of the capitalisation of global mega miner Glencore (R1.3 trillion).

Three of the companies account for practically all of this total – more than R460 billion, as at early December. All three – Gold Fields, AngloGold Ashanti and Harmony Gold – are in the JSE Top 40 Index.

Gold Fields is the largest by market cap, by far (at nearly R220 billion). It has operations across three continents. In the July to September quarter, it produced a total of 560 000 oz of gold, translating into well above 2 million oz a year.

Roughly 40% of this comes from its mines in Australia and another 50% from its mines in Ghana and SA. Yields, or the amount of gold produced from each ton of ore mined, in Australia are strong at 2.6g per ton. Only its South Deep operation south of Johannesburg has better yields (consistently above 3g/ton).

South Deep is its only remaining operation in its home market of SA. It kept the highly mechanised, non-deep-level mine and unbundled its other assets a decade ago. Sibanye Gold was the company born out of Gold Fields, and began life with just the Kloof, Driefontein and Beatrix mines. It listed on the JSE and NYSE, with a R10 billion market cap at that time. A string of acquisitions followed over the past 10 years, and it entered the PGMs sector in 2016.

Even after the recent slump in PGM prices, its gold operations remain relatively small within the context of the group when it comes to contribution to profits. Today, it is valued at around R65 billion (after being at the R100 billion mark earlier last year before the sell-off in PGMs and operators in that space).

Like Gold Fields, AngloGold Ashanti, with a market value of about R137 billion, also has operations in Australia, South America and Ghana. It produces around 2.6 million oz a year at an average yield across all its operations of 1.96g per ton. It has steadily reduced its exposure to SA in recent years.

The reality is that the remaining SA gold mines are almost entirely ultra-deep-level ones, which mean it is costly and dangerous to extract ore. Following a strategic review, AngloGold Ashanti – which originally brought together all Anglo American’s gold assets in the late 1990s – moved its primary listing to the NYSE. However, it retains a secondary listing on the JSE and enjoys strong investor support in the country.

Harmony Gold, valued at R69.6 billion, has its primary operations in SA, with new projects in Papua New Guinea and Australia. It produces in excess of 1.6 million oz a year, mostly from SA. Its active project in Papua New Guinea, Hidden Valley, remains a modest mine. It also holds a 50% stake in the Wafi-Golpu project in the Morobe province, through a 50:50 joint venture with Newcrest.

Meanwhile DRDGOLD, with a market value of R12.7 billion, differs from the other listed gold miners in that it is a surface operator. It treats surface tailings that remain dotted around the Reef. In the last financial year, it produced 170 000 oz of gold. Given that it is a ‘surface miner’, its cost profile differs markedly from a typical mine, even if not an ageing, deep-level one. It produced its gold at a price of close to R800 000 per kg. Sibanye-Stillwater took its holding in DRDGOLD to 50% in 2020. It could potentially become the vehicle to treat its parent’s PGM tailings.

Pan African Resources, with a market cap of R8.49 billion, operates two mines – Barberton and Evander. It also has two tailings treatment plants. It produced 175 000 oz of gold last year. It expects to produce between 178 000 oz and 190 000 oz of gold this year.

The risk for investors is that inflation sees miners’ operating expenses increase significantly in the near term, eating into profits. Overall, there is a trend towards M&As when gold prices and cash flows are good. This is the case at this point in this cycle, too. In late 2023, Newmont acquired Newcrest to create the world’s largest gold producer.

Both Gold Fields and AngloGold Ashanti are comfortably in the top 10, and some investors believe both are attractive acquisition targets. We could yet see a combination with a rival in the near term. This ought to provide some support to share prices, despite their arguably stretched valuations.

In 2021, in the aftermath of the COVID-19 pandemic, in its note to clients Coronation argued that ‘in an environment of heightened risks, including a global equity bull market now 13 years in the making, stretched sovereign balance sheets and inflation threatening to return, we believe the local gold counters offer a well-priced, diversified investment opportunity, as well as offering inexpensive insurance against the risks we foresee lying ahead’.

Inflation is back with a vengeance. A few large-scale wars are under way globally, with geopolitical stability an ever-present threat. Add to this that ‘material increase’ in central bank buying of gold, at above 20% for most of 2023. This is double the run rate between 2010 and 2021, which ought to be strongly supportive of the price of bullion and of gold shares in the short to medium term.

‘With geopolitical strife likely to remain high in coming years as de-globalisation continues and a multipolar world order establishes itself – between the West and China – gold is likely to maintain its strategic attractiveness in investment portfolios as a hedge against political volatility and uncertainty,’ says Van Papendorp. ‘This is already borne out by results from a recent WGC [World Gold Council] survey where 71% of 57 global central banks indicated that their gold reserves will likely increase in the next 12 months.’

It seems that the global gold bull market continues to steam ahead.