While economies worldwide are still picking up the pieces after the devastation wrought by the COVID-19 pandemic (not to mention the ensuing lockdowns and maelstrom of misinformation), a not-insignificant number of industries, companies and service providers have benefited hugely from an upsurge in demand.

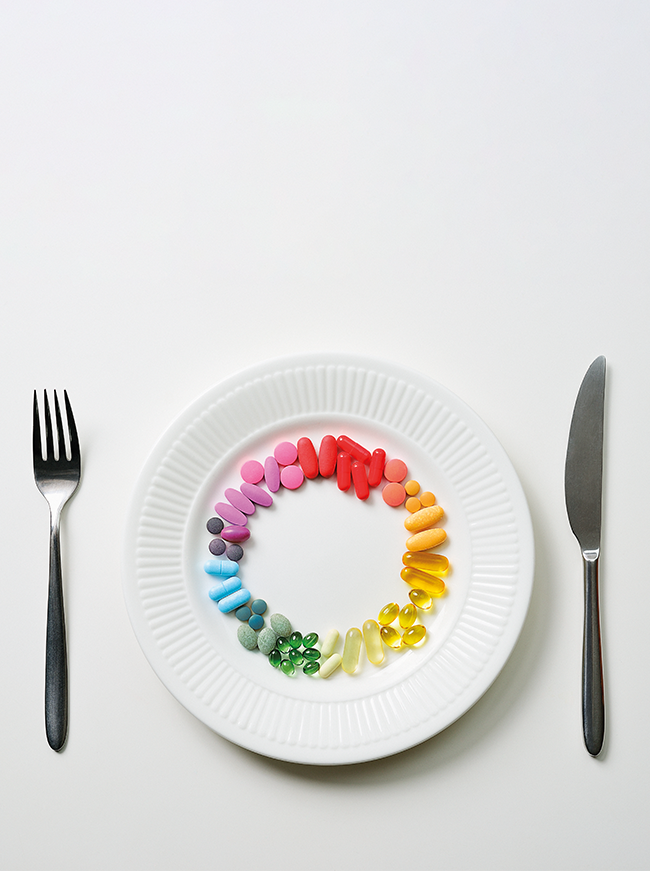

PPE supply is an obvious one. E-learning, e-health, e-commerce and online meeting providers alongside online gaming and cybersecurity. Pet-related sales took off, as did demand for home renovation supplies and services, cleaning/sanitation and delivery services. Sales of fitness equipment boomed (according to Forbes.com, yoga mats have seen one of the highest increases in sales of fitness equipment). Therapists and mental health professionals have also been very, very busy. Then, there’s the health supplement market.

Consumers’ interest in bolstering their health – their immune systems in particular – has, understandably, skyrocketed.

A report by PwC notes that the global market for vitamins and food supplements showed a CAGR of 6.3% between 2014 and 2018. That is forecast to continue to grow by 4.4% through to 2023.

Naturally, all pre-pandemic projections are obsolete, thanks to pandemic-related shifts in demand, disrupted production, compromised supply chains and unstable financial markets.

In 2018, the global supplements market was worth $140.1 billion, according to research published by Bloomberg. In 2020, a report by BusinessWire estimated the global value at $170.4 billion, with forecast value of $298.5 billion by 2027, growing at a CAGR of 8.3% during that period.

Another report by Zion Market Research placed the value of the global dietary supplements market at $191.1 billion in 2020, and predicted it would be worth $307.8 billion by 2028, growing at a CAGR of around 5.9%. Even though the estimates vary, that’s quite a jump.

What is the market worth in SA? R7 billion, according to statistics from Vital Health Foods (VHF), one of the country’s leading and Africa’s largest manufacturer of vitamins and mineral supplements, reported in BusinessDay earlier last year.

‘Vitamin C and zinc mineral supplements, the first line of defence against the COVID-19 virus, have helped boost sales in SA’s R7 billion complementary healthcare market by an overall 22.6%,’ the company says.

‘The market has seen substantial growth driven by the pandemic,’ says VHF marketing executive Julliette Morrison. ‘Three key spikes – one in March 2020, in January 2021, and in June 2021 – saw volumes increase ahead of 50% during those months. Most of the growth was in the immune segment of the market, but everyday essential segments such as multivitamins and omegas recorded strong demand.’

Pharma Dynamics, which specialises in cardiovascular medicine, also has several products that fall within the complementary and alternative medicine category.

‘Consumers have definitely become more health conscious, and the immune-boosting category in particular saw significant growth during the pandemic,’ says company spokesperson Nicole Jennings.

Gavin Harrington, head of Alpha Own Brands at pharmacy franchise Alpha Pharm, confirms that ‘there has been a lot of panic buying taking place for a range of vitamins, specifically vitamin C, vitamin D3, zinc and immune boosters. Several manufacturers battled to attain raw materials due to the unprecedented demand at that time [during the first three waves of COVID-19 infections] and leading pharmaceutical wholesalers were unable to keep up with demand. Due to the COVID-19 pandemic, there were a lot of supply chain constraints on shipping, which increased the rate of delays and shortages. At that stage, it was uncommon to see sales 1 000% higher than the normal rates of sales. To date, sales figures per month are roughly eight to 10 times higher than a traditional month pre-COVID-19, but this can climb to 20 to 25 times higher when the COVID-19 infection rate increases and an official wave has been declared’.

The surge in demand, with limited access to supply, was only one of the challenges faced by some industry players. The leading concern for Ascendis Health, which owns some of the most highly recognised brands in the health and care market in SA, was not supply (‘We are fortunate to have a large portfolio of brands that cater for most of the vitamin categories, as a result we are able to meet the consumer needs and requirements across our portfolio’) – it was misinformation.

‘The biggest focus for us during and post-pandemic has been consumer education that is credible,’ says Emma de Beer, head of category marketing at Ascendis Health. ‘There are so many messages being put out there that overwhelm consumers and we are trying to cut through this clutter by educating the consumer on ingredients’ benefits, as well as lifestyle changes that can help improve health and support immune functions.’

She describes the post-pandemic market as ‘a rollercoaster’. ‘The total market has grown by double digits since September 2020, with this number going as high as 40% during the peak of the pandemic infection waves.

‘Different categories have grown at different times of year, but immunity remains the top-performing category. With South Africans becoming more aware of the need [for] and the benefits of vitamins and supplements, I believe we will see categories that cater to broader health concerns, such as skin, energy and stress, growing more than in the past.’

VHF responded to the upswing in demand by increasing its messaging about immunity and healthy habits, as well as focusing on innovation and keeping its products affordable. ‘We have focused on ensuring availability by managing our supply chain in a difficult environment, and we have delivered innovation to bring best-in-class formulations to our consumers.’

Alpha Pharm changed its packaging and introduced several new products. ‘We have adapted packaging sizes, introduced banded combo packs – Vita C and Zinc, Vita C, D3, immune-booster combos – plus we have a range of effervescent tablets available to satisfy a broad range of customers who have different health needs and ailments,’ says Harrington. ‘We also have standard and reasonable deals in place for stockists that patients and customers can save on through bulk buying.’

So what are the most popular products? As you may have gleaned, the trend is towards immune-boosting vitamins and minerals such as vitamin C, vitamin D and zinc. This extends to immune-boosting products for children as well, says Jennings.

However, globally, probiotics and omega-3 supplement sales have also received a shot in the arm. ‘The [global] market has witnessed a surge in the demand for products that provide digestive and immune health,’ reads a 2021 report by market research company Mordor Intelligence. ‘The sales of supplements such as protein, vitamins, omega-3 fatty acids and others witnessed immense growth. […] The dietary supplements market is preliminarily driven by the paradigm shift towards preventive health management practices, amid rising healthcare costs and the increasing burden of lifestyle diseases. Furthermore, digitalisation in the retail sector is expected to further boost the future growth of dietary supplements.’

The report sees probiotics as another major dietary supplement trend, particularly among the millennial generation.

In a separate report, Mordor Intelligence identifies the UAE and SA as two territories that are ‘likely to pick up the trend faster than other countries in the region’.

‘Gummies’ (chewable gelatin vitamins) are another trend in the supplements market expected to take off in the coming years, as is demand for ‘personalised’ health supplements. This can involve anything from access to an increased range of dietary supplement products (from protein shakes to supplements, snacks, bars, muesli and other beverages), as well as ‘counselling’ services that make supplement recommendations based on a person’s lifestyle, history and needs.

Supplements that claim to reduce stress and improve sleep are also set to rise in popularity. Expect to see ingredients such as cannabidiol, magnesium, B-complex vitamins, L-theanine, melatonin, valerian and chamomile.