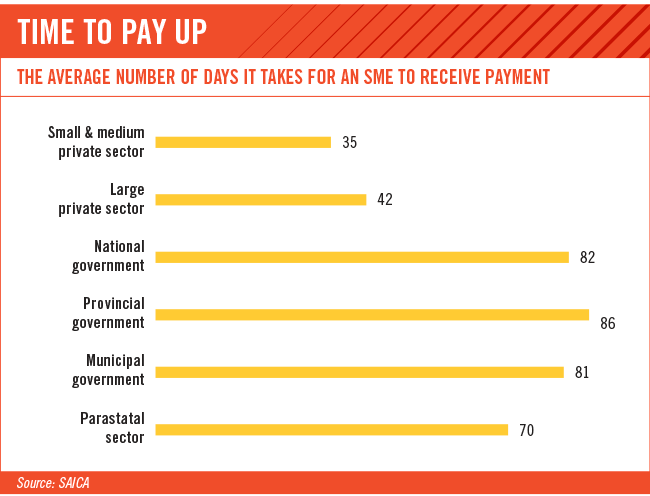

According to the Business Partners SME Index 2015, SMEs doing business with government and private companies identified funding and prompt payment for work done as key requirements for their businesses remaining sustainable.

‘Late and protracted payments by large corporates and state agencies put SMEs under unnecessary pressure. While payment delays can be easily absorbed by large companies … late payments can have potentially devastating consequences for SMEs operating in the private and public sectors,’ it stated.

Executive director of Business Partners Limited Gerrie van Biljon says irregular or delayed payments from customers continued to have a detrimental impact on the cash flows of SMEs in late 2015.

‘This restricts their chances of expanding their business and creating jobs. The way in which a business manages its working capital and the speed of its cash conversion cycle ultimately impacts on its profitability.’

Business Partners Limited – formerly the Small Business Development Corporation, started by the Rupert family in the 1980s – has been one of SA’s key SME funding and financial training and mentorship bodies, along with corporates in the insurance space such as Old Mutual and Sanlam, which run annual competitions to incentivise and reward entrepreneurs. Business Partners has several private equity funds for SMEs including brands and franchises, education, manufacturing, green technology and funds exclusively for female entrepreneurs.

Its Venture Fund focuses on funding new products or taking new initiatives to the market; businesses where job creation prospects are substantial; and at times, businesses with ‘blue sky’ potential. It says, furthermore, that it would invest in a ‘well-structured BEE transaction where wealth creation and possibly transfer of skills exist’.

Business Partners also runs several funds for property-related transactions, including the acquisition of a business or industrial property to enable entrepreneurs to not spend on rentals.

‘Business Partners exists to fulfil the needs and requirements of entrepreneurs exclusively in the small and medium-sized sector,’ the company states on its website. ‘We invest in these businesses, stand beside them and champion their cause.

‘Our talent lies in our ability to unearth entrepreneurs and help them transform their lives as well as the lives of those they touch through their entrepreneurial endeavours.’

Meanwhile, the South African Institute for Chartered Accountants (SAICA) remains at the forefront of running programmes through its ‘nation building’ transformation initiative that offers financial training to black SMEs. This includes the Hope Factory – a collaborative SAICA partner – which helps SMEs become legally compliant with tax and other legislation that govern small businesses, so that they qualify to apply for funding as the black-owned businesses grow.

SA banks are also involved in SME training and support in one form or another. According to Nedbank Group CEO Mike Brown, in the past three years it has provided more than R20 million in enterprise development assistance to emerging black SMEs.

‘This has benefited more than 2 000 black entrepreneurs and SMEs. We provide mentoring and skills and other interventions aimed at supporting their success. Some of these initiatives consist of collaboration with the Branson Centre – this service provides mentoring and finance training to 200 SMEs and has resulted in the creation of more than 290 additional jobs.

‘We also appointed the Expanded Public Works Programme as its preferred service provider for the Vuk’uphile learnership programme. This project is aimed at developing emerging contractors and – after five years and partnering with 24 implementing authorities at national, provincial and local government level and in some cases state-owned enterprises – 554 learner contractors had been set up.’

Nedbank also contributed R41 million to date in mentorship funds that saw 2 977 job opportunities created, and thus far no write downs of bad debts have been incurred.

Another support initiative is SwiftReg, an inhouse supplier development programme that offers a ‘holistic approach’ to developing suppliers and easing red tape involved in registering an SME. By March this year, SwiftReg had enabled approximately 12 220 companies to register seamlessly at Nedbank branches.

SMEs also benefit from the bank’s 10-year-old small-business seminars that provided practical solutions and advice to more than 30 000 small-business owners across the country.

‘We also offer various business and finance-related IT software solutions to SMEs,’ says Brown. ‘Last year, we invested R15 million in partnerships with radio station 702’s Business Accelerator and Khaya FM to drive real engagement and learning with business owners. At primary schools, the Nedbank 4me entrepreneurial days initiative ensures learners are educated about entrepreneurial skills. The initiative has reached some 72 000 learners and 100 000 parents to date. And at Stellenbosch, we’re involved in LaunchLab, a R6.5 million sponsorship of a technology lab to provide critical support to incubate new business ideas.

‘At Diepsloot, near Johannesburg, we partnered with Riversands Incubation Hub to grow and develop SMEs in and around the township.’

Nedbank is also among the many listed SA corporates and banks that are contributors to the new venture capital, the SA SME Fund. More than 70% of the Top 40 JSE-listed companies – including the JSE itself – have committed an initial R1.5 billion to set up the fund in a bid to stimulate a more vibrant and rigorous SA private equity and venture capital regime in support of SMEs. In what has become known as the ‘CEO initiative’, the move forms part of renewed private-sector, government and trade union co-operation aimed at averting a sovereign downgrade by international ratings agencies.

Monetary contributions by the private sector will be augmented by day-to-day training and mentorship support as entrepreneurs will have access to vast financial and business training by retired and senior executives of corporates. Government has also pledged an equal monetary contribution after its next budget.

‘Other business leaders who are driving this new initiative are Sim Tshabalala, Standard Bank joint CEO, Dan Matjila, CEO of the Public Investment Corporation, Adrian Gore, founder and CEO of Discovery, Brian Joffe, [former] CEO of the Bidvest Group, Ralph Mupita, CEO of Old Mutual Emerging Markets and Vassi Naidoo, chair of Nedbank,’ says Brown.

‘Entrepreneurship and the development of small businesses are central to the future of our country because they fuel growth and create much needed jobs. It’s critical that the work being done on the structural reform of the economy to promote faster and more inclusive growth continues without interruption or distraction.’

Sanjeev Orie, CEO of FNB Business Value Adds, says investment in township-based enterprises could be a game-changer for SME development, especially if the funds are invested with those of high-growth potential. ‘SA’s townships have always been a hive of entrepreneurial activity but the main challenge is unlocking the potential to generate broader economic benefits.’ Referring to the Gauteng government’s R300 million allocation set aside last year to support township businesses and co-operatives, he says a project of that nature would require strong collaboration between the public and private sectors as both spheres are critical to creating an enabling environment for these businesses to survive and grow.

‘This means that the banking sector in particular needs to be one of the key partners in the initiative to play an essential role in the process of formalising township-based enterprises and helping them gain access to capital and a wide range of other business enablers,’ he says. ‘One of the main challenges in township businesses is their lack of business processes that could enable them to get financial assistance.

‘Even where businesses are potentially viable, the fact that they have no track record makes it difficult for a bank to provide financial support. This problem could easily be solved by, for instance, opening a standard business account, making it easier to pull financial information.’

He says the solution to making SMEs sustainable and boosting job creation lies in formalising township economies, integrating SMEs into the supply chains of various industries and approaching SME development according to key sectors.

The 2015 SME Insight Report (commissioned by SAICA), states that while SMEs regard red tape as the most significant barrier to entry into the formal economy, ‘technical assistance makes a significant difference to the success or failure of SMEs’, and that the country needs to ‘significantly scale and improve the efficiency of its SME funding agency’.

As Lisa Klein, acting CEO of the SME Fund told Business Day, money from existing private equity and venture capital funds are not always successfully deployed. ‘Often it hasn’t necessarily led to the creation of jobs and enterprises that are sustainable and actually grow to be national champions,’ she says. ‘Our view is that this [SME] fund – which is going to be co-investing with existing funds – has the potential to do that, because you’re using the existing delivery mechanisms who understand the space to invest for you.’