The platinum sector is running white hot. Even though the price of the metal is lower than the nearly $1 300 per ounce reached in February last year, it remains around the $1 000 level – comfortably ahead of the $642 multi-year low reached in March 2020 as the world headed into COVID-19 lockdowns. With leverage provided by a weaker rand-dollar exchange rate, miners in the country are proverbially printing cash.

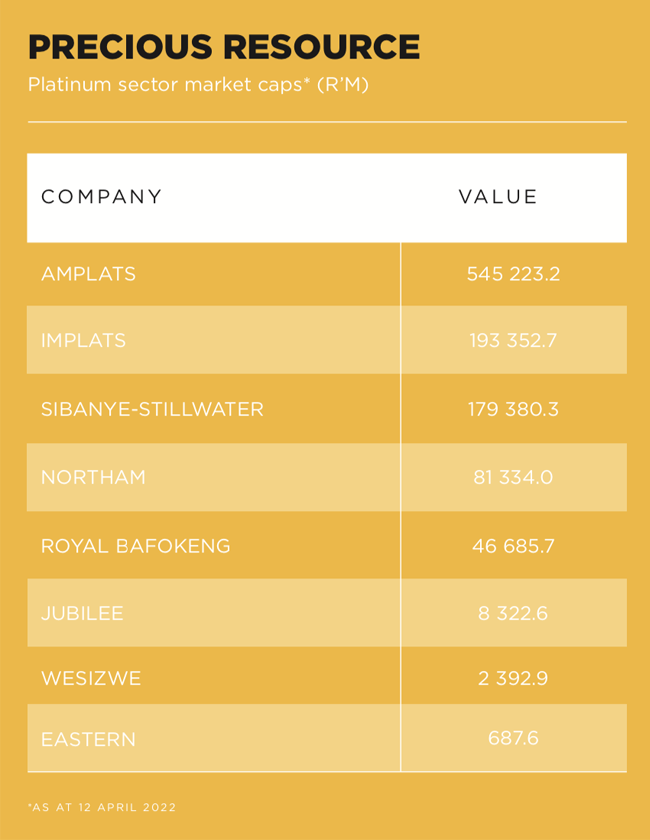

Anglo American Platinum, the largest PGMs producer listed on the JSE by market value, saw its share price soar to around R2 500 from a lockdown low of just R556. Over the past five years, its share price is up more than 500%. Other large miners are up multiples of 100% – Impala Platinum, the second-largest producer in the sector by market cap, is up more than 360%, while Northam Platinum is around 275% higher since April 2017.

SA is the world’s largest producer of PGMs – which comprise primarily platinum, rhodium and palladium – and the market value of companies listed in the sector tops R1 trillion.

‘The sector itself, like most commodities, is supply constrained. Mines haven’t really been expanding – while there has been some expansion, most of this been to replace what’s been mined already,’ says Piet Viljoen, executive director and portfolio manager at Counterpoint Asset Management.

‘As an industry, PGM miners haven’t really expanded much over the past four or five years. This puts upwards pressure on PGM metals [prices] to the extent that demand for them continues growing. The main demand is from the automotive sector, and the big question is, “does the automotive sector continue growing – and continue growing the demand for PGMs?”.’ He highlights that, in the near-term, due to the global chip shortage, car manufacturers cannot manufacture as many vehicles as they would like at the moment.

Johnson Matthey, which publishes the seminal report annually on the market, says that SA will produce around 4.5 million oz of platinum in 2021, of the total primary supply globally of around 6.1 million oz. That equates to nearly three-quarters of global production. Russia accounts for about 10% of global production, with remaining markets responsible for the other 1 million oz.

The demand picture has been fairly stable, with the exception of the impact of COVID-19. Of the 8.5 million oz of platinum required in 2019, use in autocatalysts was responsible for around 2.9 million oz. These catalysts convert harmful exhaust gases from internal-combustion engines to benign ones in a more efficient way than any other material. This makes the sales of vehicles a key driver for demand of platinum, palladium and rhodium. The former is exposed to diesel engines, while the latter two are more exposed to petrol-car sales.

In 2019, industrial use of platinum totalled 2.4 million oz, while jewellery demand was 2.1 million. Investor demand was 1.1 million oz. Factor in around 2.1 million oz of recycling and total net demand was 6.4 million oz. The difference is either obtained from or added to stockpiles globally. In 2019, for instance, Johnson Matthey says the market was in deficit by about 315 000 oz (which was drawn from stockpiles), while last year, the market was forecast to be in surplus by 615 000 oz.

Primary supply of palladium (6.7 million oz in 2021) is around 10% higher than that of platinum, with supply more evenly matched between SA and Russia (forecast at around 2.6 million oz each last year). With this metal, 85% of demand is for use in autocatalysts, with a far higher percentage of supply coming from recycling (3.6 million oz last year). For rhodium, use is almost entirely for autocatalysts, with 83% of primary supply coming from SA.

The strong level of demand, coupled with higher metals and commodity prices, has resulted in a bumper tax windfall for SA. Total tax revenue in the year ended March 2022 was R1.564 trillion, versus an estimate in February of R1.547 trillion. The original estimate from February 2021 was R1.365 trillion. This means revenue collection was practically R200 billion higher than forecast, much of this from commodity and metals producers.

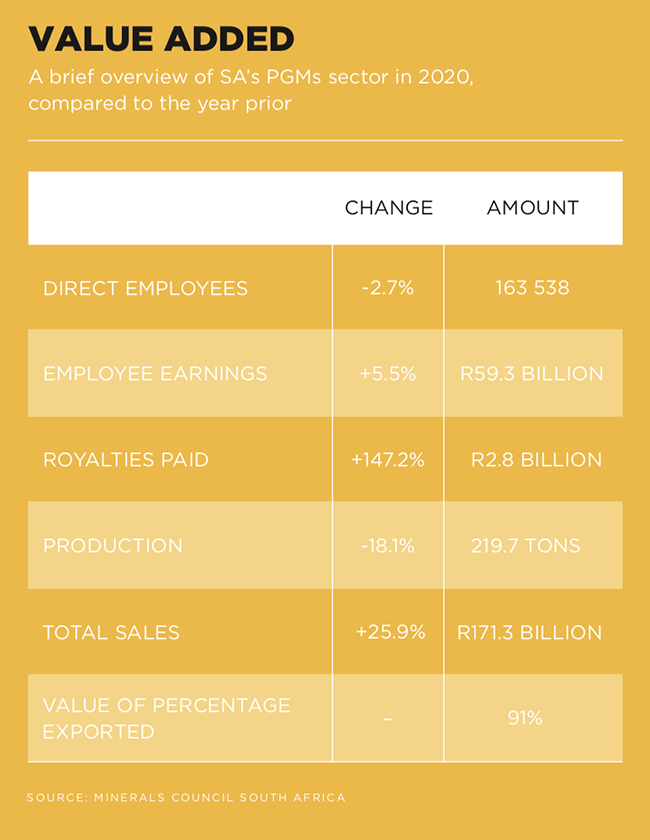

PwC says ‘there is no doubt that the PGM industry is currently in a commodity-boom cycle. This is evident not only in the increase in revenues, but also the increase in profitability’. Sales of PGMs totalled R300.7 billion in the 2021 fiscal – 38% of the total (across PGMs, coal, iron ore, gold and other products).

In an analysis, PwC says PGM miners in the country saw revenues increase by 74% in 2020 while earnings before interest and tax grew by 174%. Royalty expenses for PGM miners increased by 184%. It says SA’s mineral royalties tax regime ‘therefore succeeds in allowing the fiscus to share in the upside in a commodity-boom cycle’. It adds that the royalty rate applicable ‘has a ceiling at the maximum rate […]. Once the tipping point in profitability has been reached, there is no longer any upside to the fiscus’.

The analysis shows that PGM miners have a direct and indirect impact on GDP of around R1.2 million for each R1 million in sales. For that same R1 million in sales, more than four jobs are created.

Around a decade ago, Anglo American Platinum (Amplats), the world’s largest producer of the metal, embarked on a large-scale restructuring to return its business to profit. In 2012, it reported a headline loss of R1.5 billion, which saw it unveil a plan at the start of 2013 to retrench as many as 14 000 workers. This was pared back to 6 000 workers as the producer consolidated, sold and shut operations. Then Anglo American CEO Cynthia Carroll described the sector as one ‘in crisis’.

In all, it disposed of its Rustenburg operations, as well as so-called long-dated resources at Amandelbult, its majority shareholding in Union mine, and its interest in JV Pandora. The protracted restructuring eventually paid dividends as the producer declared its first pay-out in six years at the start of 2018. The final dividend was R3.49 on headline earnings per share (HEPS) for 2017 of R14.82. Last year, it produced 5.1 million oz of refined PGMs – a record amount. This translated into HEPS of R300.42 – 20 times the level from four years prior. Dividends, including a special dividend, totalled R30 per share for the year.

Amplats is similar to Kumba Iron Ore in that both Anglo American subsidiaries are majority-owned by the global diversified miner Anglo American but are also listed on the JSE. Amplats’ parent owns 79.9% of the platinum producer. It currently owns and operates five mines in SA’s Bushveld Igneous Complex, including its flagship Mogalakwena project, as well as Amandelbult and Mototolo. It also owns smelting and refining operations near these properties, where it treats concentrate from its mines, JVs as well as third-party miners. It owns the Unki mine in Zimbabwe too.

As an illustration of the sheer scale of Amplats, rival Impala Platinum (Implats) reported PGM production of 1.6 million oz for the second-half of 2021. It owns its namesake Impala operation near Rustenburg as well as Marula on the eastern limb of the Bushveld Complex. It also has a stake in the nearby Two Rivers JV, which is managed by JV partner African Rainbow Minerals. It owns Zimplats and JV Mimosa (together with Sibanye-Stillwater) in Zimbabwe, and pure-play palladium producer Impala Canada near Ontario, Canada.

In November, it surprised the market with an offer for smaller rival Royal Bafokeng Platinum (RBPlat), whose operations lie adjacent to Impala, near Rustenburg. The proposed acquisition ‘will secure a western limb production base to enhance and entrench the region’s position as the most significant source of global primary PGM production, and will deliver tangible socio-economic benefits for the region, its communities and South Africa’, it says. It offered R150 per RBPlat share in a mix of cash and Implats shares (in a 60/40 ratio) and secured support from the independent board of its smaller rival. After originally securing a 24.5% shareholding, it has steadily purchased additional shares. At the end of March, it held 37.6% of RBPlat.

The attractiveness of the RBPlat asset became obvious in November, when Northam Platinum entered what had effectively become a bidding war for the company. Northam acquired a 32.8% interest in the group from its former majority shareholder, Royal Bafokeng Holdings (RBH) for R17 billion (or R180.50 per RBPlat share). As part of the transaction, RBH will obtain an 8.7% strategic shareholding in Northam. ‘This shareholding creates significant long-term optionality for Northam. It aligns perfectly with our long-term growth, sustainability and diversification strategy, and the introduction of Royal Bafokeng Holdings as a significant shareholder further strengthens our empowerment credentials,’ according to Paul Dunne, CEO of Northam Holdings.

‘We believe the complementary metals mix of RBPlat, with a higher relative platinum contribution, fits well within the broader Northam metals basket. The RBPlat assets are young, shallow and well capitalised, and occupy a strategically important position in the Western Bushveld.’ At this point, there are now two PGM majors vying for RBPlat, with another nearly 30% of RBPlat shareholders happy to not support either offer at this point.

Northam is a noticeably smaller producer than Implats, with production of around 700 000 oz per year. It has three main operations, Zondereinde and Eland (on the western limb) and Booysendal on the eastern limb.

Dunne says RBPlat’s assets tick a number of boxes, in that ‘the acquisition of cash-generative, producing and sustainable assets with further growth potential offer the most compelling value’. He adds that the group’s ‘bottom-up analysis of PGM resources and reserves across the world indicates that we can expect, as we move to 2030 and beyond, that there will be a diminishing primary supply of platinum and rhodium, while palladium supply could remain flat, with later growth’.

Sibanye-Stillwater, with a market value of nearly R180 billion, began life as a gold producer when Gold Fields took the decision in 2013 to unbundle its SA deep-level operations. In 2016, it acquired Aquarius Platinum to mark its entry into the PGM space, with a deal sealed for Amplats’ Rustenburg operations later that year. A year later it bought Stillwater Mining in the US for $2.2 billion, the largest PGM transaction globally for more than 10 years. In 2019, it bought Lonmin Plc, which owned Marikana, near Rustenburg.

It produced 1.8 million oz of PGMs in SA last year, and an additional 1.3 million oz in the US (production and recycling). It remains a sizeable gold producer, with nearly 1.1 million oz produced locally. CEO Neal Froneman told investors earlier this year that Sibanye-Stillwater believes ‘PGM demand will remain well supported well into the 2030s, and it’s predominantly because internal combustion-engine vehicles have a substantial future, much more than what I think is being given credit to’.

Wesizwe Platinum, with a market value of R2.4 billion, has been constructing its flagship Bakubung mine since 2011. The miner notes this is ‘currently behind in its construction schedule’, and says it will share updated time lines in its annual report in the coming weeks.

Jubilee Metals Group differs from other producers listed in the sector in that it doesn’t actually mine PGMs. It operates a PGM and chrome-processing plant, which processes historical tailings material also owned by the company. In addition, it owns a copper and cobalt project in Zambia, as well as additional chrome plants in SA. Smaller Eastern Platinum is listed on both the JSE and Toronto Stock Exchange. It has four PGM assets in the Bushveld Complex, and currently produces a modest amount of chrome via a re-treatment plant.

Because of how important vehicle sales are for demand of PGMs, the coming shift to electric vehicles will have a profound impact. Edison Research notes that unlike palladium and rhodium, ‘platinum is also used in fuel-cell electric vehicles and could therefore benefit from the likely increase in hydrogen adoption’. It adds that hybrids and ‘fuel-cell electric vehicles will likely see PGM demand equal to or greater than current usage for internal combustion engines’, because fuel cells currently use more platinum than petrol or diesel technology, and no palladium.

Edison sees a ‘balanced market for platinum in the short term, followed by large deficits from the late 2020s onwards, due to growing demand from the developing hydrogen economy. For palladium, we see growing surpluses and for rhodium large deficits to 2028 followed by surpluses thereafter’. This mostly bodes well for producers of these metals.

Viljoen is more bullish. ‘A lot of people say, when electric vehicles come in, PGMs won’t be needed as catalysts for internal-combustion engine [ICE] vehicles anymore.’ He believes that ‘EVs are still a tiny fraction of the global market and could remain so for a long time, and that new ICE car sales will continue for the next 10 years. The demand for PGMs will continue to grow at the rate of global GDP growth, as it has done in the past. There is an upside to prices in the short term, and possibly some additional upside due to the situation in Russia, given they are a significant source of PGMs’. Viljoen cautions, however, that ‘in the short term anything can happen’.