In Japan, they call it muda. Wastefulness. And there are seven kinds of it, from wasted product (over-production) to wasted time (waiting around) to wasted space (too much inventory cluttering up your warehouse). Toyota founder Sakichi Toyoda detested muda and, together with his son Kiichiro Toyoda and Toyota chief engineer Taiichi Ohno, he created a production system that eliminated it in all its seven forms. The result was ‘just-in-time’ or ‘lean’ manufacturing, and it’s been studied in business schools since the 1970s.

Today, according to the US Council on Foreign Relations, ‘it is the dominant mode of manufacturing worldwide. However, there is no room for error; a single delay jeopardises the whole process’. In other words, it works until it doesn’t. Because what you gain in terms of efficiency, you lose in resilience – and the COVID-19 crisis has tested that resilience beyond its breaking point.

In a Gartner survey, 76% of supply-chain executives indicated that, compared to three years ago, their company is now facing more frequent disruptions in their supply chain. That, at a time when logistics managers have been working frantically to keep essential supplies on shelves, and to keep people safe by delivering PPE to the healthcare front lines.

Yet by late-2021 the supply-chain mechanism that balances the global forces of supply and demand had collapsed. As Tony Pelli, practice director of security and resilience at the British Standards Institution, puts it in a Business Insider Africa article, ‘all parts of the supply chain, most of which are built on “lean” principles – no slack, little redundancy, from truck drivers to inventory in warehouses – were not prepared for this increase [in demand]. While consumer demand can increase in a matter of months, it takes more time to increase port capacity, build warehouses, hire employees, etcetera, to meet that demand’.

For MJ Schoemaker, however, the crisis has brought a small silver lining in that the importance of supply-chain risk-management planning has been brought to the forefront. Schoemaker is president of the Professional Body for Supply Chain Management (SAPICS), which – like everybody in the industry – spent 2021 contending with issues such as the blockage of the Suez Canal, the unrest in parts of SA and the ransomware incident at the Port of Durban.

‘New challenges are emerging almost daily, like the COVID-induced global supply-chain crisis, for container shipping and, now, the power crisis across Asia and Europe, which is expected to result in supply shortages ranging from textiles and electronics to machine parts,’ she says. Add to that the explosive rise in global e-commerce and the worldwide shipping-container shortage (which Reuters memorably dubbed ‘Containergeddon’), and you have a bona fide disaster.

Schoemaker believes the crisis is bringing an overdue shake-up to the logistics and supply-chain industries. ‘While supply-chain risk control is something that has been spoken about for some time, and SAPICS provided numerous learning opportunities for supply-chain professionals in the past, until the pandemic only a handful of industries really embraced supply-chain risk management. That is changing,’ she says.

‘There is a growing recognition of the need for all businesses to build robust monitoring systems to evaluate and assess all types of risk. These assessments must include the detailed mapping of supply chains and suppliers. It is now clear to many organisations that they cannot rely on tier one suppliers to control and manage their risk and ensure stability from tier two, three and four suppliers.

‘To mitigate the risk of supply-chain disruptions, businesses’ strategy must include an alternative supplier network and flexible batch sizes. Cost can no longer be the overriding factor in setting up supply chains, and it is evident that geographical risk is also very important to continuity of supply.’

Schoemaker adds that more organisations now understand the importance of supply-chain visibility and exception management in their end-to-end supply chain. That’s placing extra emphasis on the need to identify the right partners and building win-win relationships with all suppliers, and on collaborative planning and execution with supply-chain partners and service providers.

‘This is how organisations will mitigate their risks and weather any future chaotic supply-chain disruptions,’ says Schoemaker.

And ‘chaotic’ really is the right word for it. The impact of the recent supply-chain disruptions on SA businesses was significant. As Thinus Ferreira, COO of Cape Town-based wood-preservative manufacturer Dolphin Bay, explains, it is exceptionally frustrating to deal with the extreme challenges of shipping. ‘We constantly try to change things, but shipping lines provide no answers to our questions. Shippers are at the mercy of the shipping companies, and they know it.’

Dolphin Bay has since taken to trucking its chromated copper arsenate containers to its clients across Africa. ‘We’re choosing to take on all the hurdles this entails, rather than wait indefinitely for a vessel to transport our timber preservatives,’ he says. ‘We know, out of experience, that we do this at great risk to our company.’

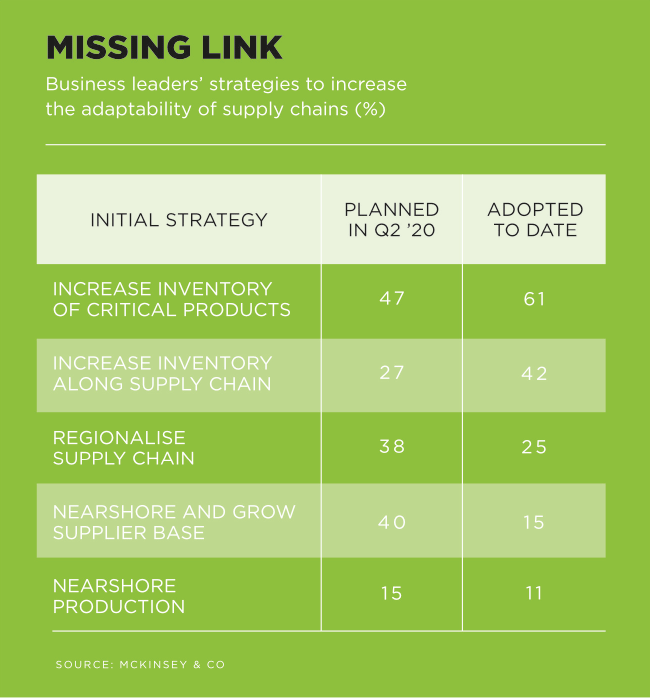

It seems wasteful, but what else are businesses supposed to do? Some are looking to solve the problem on the supply side by sourcing materials closer to home. In a recent McKinsey & Co survey, almost 90% of respondents said that they expected to pursue some degree of regionalisation within the next three years, and 100% of respondents from both the healthcare and the engineering, construction and infrastructure sectors said the approach was relevant to their sector.

More than half of SA’s clothing, textiles, shoes and leather products are imported – and most of them come from China. Prompted by government tax incentives, and pushed by the supply-chain crisis, retailer the Foschini Group (which already sources about 70% of its clothes locally) confirmed recently that it would be sourcing more products from SA suppliers.

‘Most furniture in South Africa is currently imported; we are looking at various options to manufacture more here, particularly at the moment when shipping costs are up 400%,’ says TFG CEO Anthony Thunström. TFG plans to spend R575 million over up to five years to build local manufacturing capability.

That – and similar moves by retailers Pepkor and Mr Price – will be music to the ears of local consumers, as well as Ebrahim Patel, Minister of Trade, Industry and Competition. In his address at November’s 2021 Manufacturing Indaba, Patel highlighted the benefits of developing regional value chains across Africa, which, he said, would create market linkages, integrate critical supply chains and replace some products that are currently being imported from other continents. ‘The African market represents a R7 trillion market opportunity for goods that can be manufactured on the continent,’ he said. ‘However, for these opportunities to materialise, there’s a need to resolve the structural constraints that may prevent Africa and South Africa from seizing the opportunities presented. We’re on the cusp of a potentially great renewal in local manufacturing that can drive increased output and competitiveness – what we call re-industrialisation.’

Juanita Maree, CEO of the South African Association of Freight Forwarders, agrees that localisation (with a focus on export promotion) is a key strategy to tackling the supply-chain crisis brought on by the pandemic. ‘These events have highlighted how fragile supply chains are and how they can affect the well-being of South Africa’s economy,’ she says. ‘It is, however, paramount that the focus is redirected towards finding intelligent ways to deal with South Africa’s unique challenges.’

Maree adds that Industry 4.0 technologies should be promoted to ease the logjam. ‘Using technology to analyse risk patterns and identify which consignments need to be stopped could go a long way to reduce unnecessary delays and costs,’ she says. ‘There are already various blockchain-technology projects under way within the international trade environment. For customs processes specifically […] the expected benefits include enabling customs to become more data-driven, enhancing revenue compliance and co-operation between tax and customs, and assisting customs to better combat financial crimes.’

All of this will be encouraging for SA’s importers and exporters – and for the country’s manufacturers and factory workers … at least, in the long term. In the short term, though, businesses and consumers across the world are facing many more months of unfulfilled inventories, empty shelves and bare cupboards.

When those backlogs are eventually cleared, importers and exporters will be left to reflect on wasted time and wasted resources. Those who promote and support local manufacturing will do their best to ensure the supply-chain crisis is not also a wasted opportunity.