PPS Investments started in 2007 and is a subsidiary of the 80-year-old PPS, a holistic financial-services company specialising in bespoke financial solutions exclusively to graduate professionals. Operating under the ethos of mutuality, PPS shares 100% of its profits among its qualifying members through the PPS Profit-Share Account. PPS Investments offers a suite of flexible investment solutions that covers pre-retirement, post-retirement and wealth creation.

Investment solutions include pre-retirement preservation funds and retirement annuities; post-retirement living annuity, living annuity with lifetime income (available exclusively to PPS members) and Vested PPS Profit-Share Account (also available exclusively to PPS members); and wealth-creation solutions include an investment account, endowment plan and a tax-free investment account.

INVESTMENT HOUSE

The investment team believes that investors should have access to different investment styles to build a sensibly diversified portfolio. As such, PPS Investments offers a range of single- and multi-managed funds that are carefully researched and constructed to suit most investment needs, risk appetite and time horizon.

By tapping into its multi-manager philosophy and in-depth research, clients gain access to the country’s top asset managers combined into one solution. The investment team offers the opportunity for optimal diversification by blending an appropriate combination of investment styles and asset classes that are best suited to take advantage of opportunities at different times in the cycle.

The five fundamental pillars of this investment house are their people, philosophy, process, performance and product.

PPS FUND RANGE

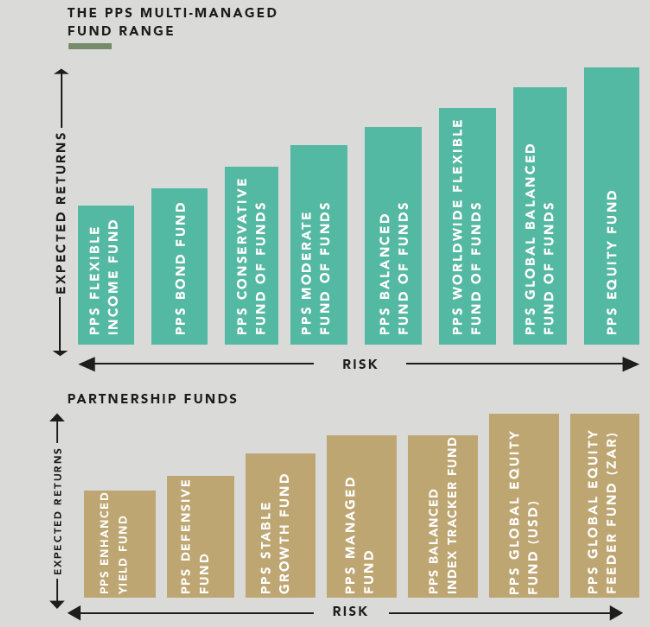

The carefully constructed PPS fund range offering is geared to meet the investment needs at every life stage of PPS members, their families and other discerning investors, too. PPS multi-managed funds blend carefully selected asset managers – each with unique skills and expertise – into a single fund. These funds are suitable for investors across the risk spectrum, at competitive prices. Investment expertise, manager research, manager selection and optimal blending are all packaged into one fund.

In addition, the PPS single-managed or partnership funds are expertly managed by one premium, specialist asset manager carefully selected by the investment team. Funds in this range offer access to managers that add value through their proven investment philosophies, experience and expertise. Furthermore, it affords added opportunities for diversification at attractive prices.

COMPETITIVE ADMINISTRATION FEE STRUCTURE

As a platform, PPS Investments offers appropriate and flexible solutions with transparent fee structures. No initial administration fee is charged and clients could pay reduced ongoing administration fees based on the total amount invested on their platform. A tiered scale is applied to the annual platform administration fees applicable to the PPS select range of funds.

REDUCED FEES FOR FAMILY MEMBERS

The PPS Investments Family Network enables clients to connect their family’s investments on the platform, enabling them to benefit from a reduced administration fee. The more the client and their family invest, the more everyone could benefit.

BOOST PPS PROFIT-SHARE ALLOCATION

When investing, clients can enjoy even more profit-share allocation as a qualifying PPS member by:

- Choosing PPS funds and solutions as they earn profit share on their holistic portfolio

- Linking their spouse, children, parents and parents-in-law invested on the platform

- Holding more products from across the PPS group, and tapping into the booster benefit accessible through PPS Profit-Share Cross-Holdings Booster.

EASE OF SERVICE

A PPS investor has access to their investment information and are able to do online transactions safely and confidently on the PPS Investments Secure Site.